TOP 10 PERFORMANCE IMPROVEMENT MISTAKES

Part 7. We’ve Saved Millions!

In previous issues of this series, we have explored the importance of linking performance improvement endeavors with organizational strategy, obtaining leadership buy-in, decision-making based on data and analysis, and the appropriate scoping of projects and events. Even with all those things in place, there is one common mistake that can cause a deployment to fizzle, falter, and fail. All performance improvement (PI) deployments have one factor common: the expectation of quantifiable, measurable results.

Making the commitment to invest in a PI deployment; in training, developing, and supporting PI practitioners, investing and empowering PI teams, and championing and chartering PI projects and events is more than the right thing to do. There are a business reasons for investing in PI and there is an expectation of a return on that investment, often in a very short timeframe.

When the deployment fails to deliver or (just as importantly) to document the anticipated results, enthusiasm wanes, practitioners become discouraged, and deployment credibility disintegrates. Many of the ‘failed’ deployments cited in the literature accomplished impressive operational results, at least initially. But, because they failed to document a credible positive impact on the bottom line, those results did not figure favorably into a cost:benefit analysis of the deployment. Leadership support and resources dried up, practitioners moved on, and PI became yet another ‘flavor of the day’ that had lost its savor.

Just as deleterious to a PI deployment as failure to link operational efficiencies and performance improvements to financial benefits is the inflation, whether intentional or accidental, of project or event savings and return on investment. There are several reasons this is likely to occur without the appropriate guidance and controls. Practitioners do not, generally, have a background in accounting. They are trained to calculate the operational improvements achieved from eliminating waste, managing constraints, and reducing errors. Translating these operational improvements into financial terms is beyond their scope of expertise.

Practitioners may not understand or have access to the data necessary to calculate the cost of implementing improvements. These costs may include personnel, software or hardware, and capital expenses that must be deducted from gross savings for a net project or workshop return. Deployment metrics that link financial returns to measures of practitioner performance might provide an incentive for practitioners to over-estimate the financial benefits. For these reasons, the role of a financial subject matter expert, sometimes called a ‘Money Belt’ is essential to any PI deployment.

During the early phases of a PI deployment, the Chief Financial Officer (CFO) must be involved in executive leadership training and deployment planning activities. The deployment leader should be made keenly aware of the potential failure modes associated with lack of financial leadership and the development of deployment infrastructure to support a robust process for estimation, validation, tracking, and reporting of financial benefits.

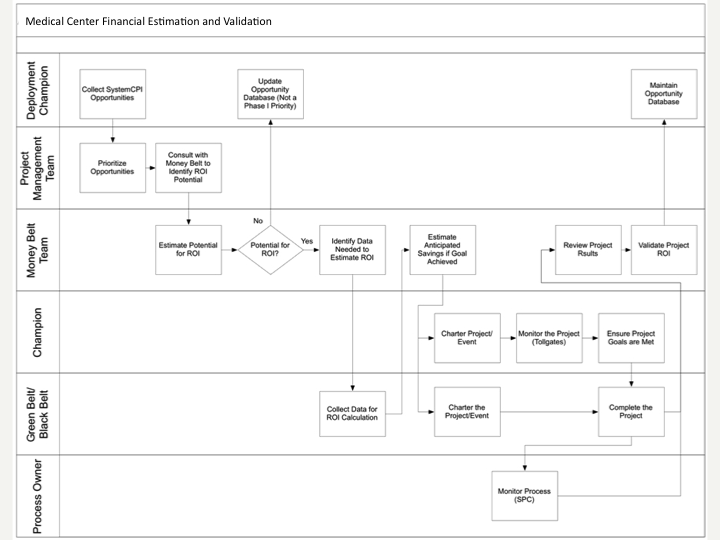

These processes are documented in standard operating procedures (SOPs) and applicable policies. Roles and responsibilities are defined. Tools and templates are developed and standardized to ensure that the process is effective and efficient. Key terms and calculations are clearly defined. Those who will function as ‘money belts’ are trained in PI methods so that they will understand their role and responsibilities. Financial estimation and validation tasks are included as expected and necessary steps in the charter, review, and closure of PI projects and workshops.

Consistently adhering to a process similar to the one illustrated above will ensure that financial expertise is available when it is needed. Operational improvements will be translated appropriately to financial benefits. Financial calculations will be accurate and meaningful. Estimates of project and event benefits will be reasonable and realistic, based on established organizational accounting practices. The financial results of PI projects and workshops will be validated by finance and credible. The PI program will be measured and monitored in terms of financial return on investment, with projects and workshops selected deliberately to bend the curve. Reporting will be aligned and leaders will be able to articulate the value of the PI deployment to the organization. PI will be recognized as a highly effective means to an end (fiscal viability) and not just one more thing to add to the 'To Do' list.

PREVIOUS ISSUES

Part 1: Create an Inventory of Experts

Part 2: It's All About Quality

Part 5: The Theory of Evolution

Part 6: Searching for the Golden Ticket

Follow Us: